riverside county tax collector change of address form

Office of LA County Assessor Jeff Prang Committed to establishing accurate fairly assessed property values. Estimate the amount of supplemental tax you can expect to pay change in ownership only.

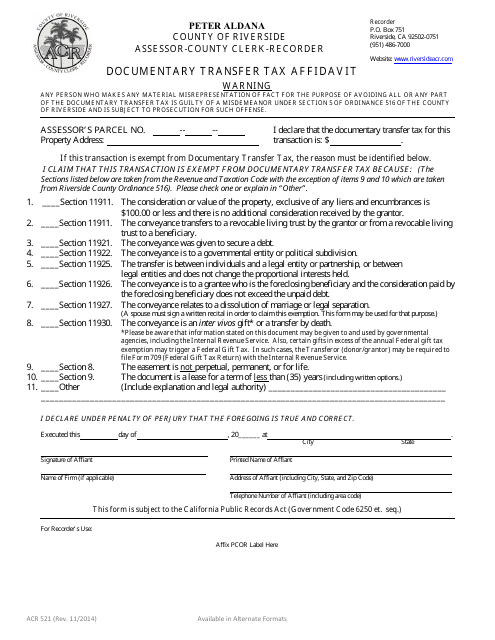

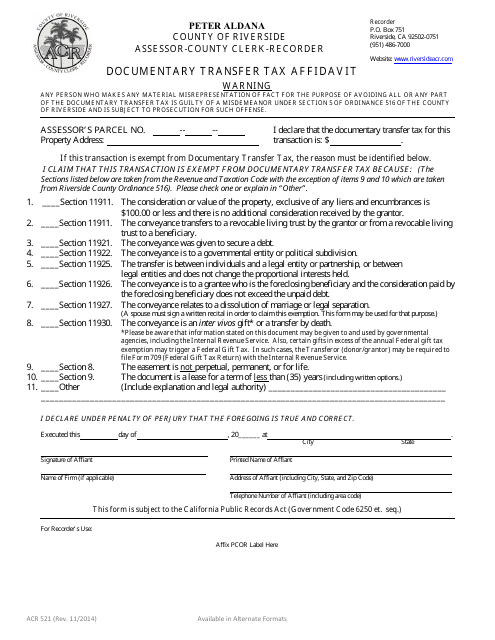

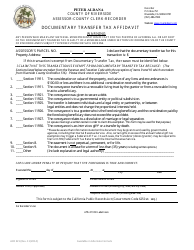

Form Acr521 Download Fillable Pdf Or Fill Online Documentary Transfer Tax Affidavit County Of Riverside California Templateroller

Welcome to Riverside County Assessor Online Services.

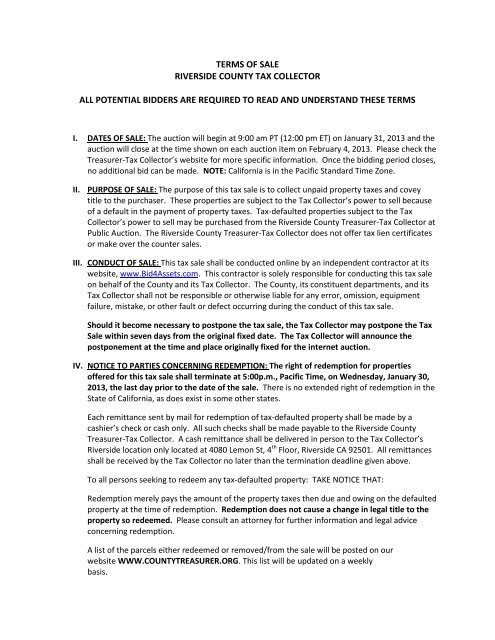

. AR1 Revolving Fund Request Order and Change Form. The Riverside County Treasurer-Tax Collector is responsible for the billing and collection of property taxes and for the receiving processing investing and most importantly safeguarding of public funds as mandated by the laws of the state of California. Additionally many transfers are subject to Documentary Transfer Tax and some may trigger an IRS.

FAQs - Property Tax. TTC Public Record Form. 951 955-6200 Live Agents from 8 am - 5 pm M-F.

Request for Change of Address Download and Print Assessor services remain available by mail email and phone. Claim for Refund of Taxes Paid andor Penalties Paid. 800 am - 500 pm.

The Assessor must determine a value for all taxable property and apply all legal exemptions and exclusions. 951 955-6200 Live Agents from 8 am - 5 pm M-F Click Here to Contact Us. 4080 Lemon Street 11th floor.

The Riverside County Tax Collector is a state mandated function that is governed by the California Revenue Taxation Code Government Code and the Code of Civil Procedures. The combined office is led by Jon Christensen a countywide publicly elected official serving the fourth largest county in. Tax Bond Estimate Request Form.

Reporting Procedures for Cash Overages and Shortages AR3 Cash OverageShortage Daily Report-Cashier. Business Personal Property. Request For Cancellation of Penalties.

Redevelopment Tax Increment Summaries FY 13-14. Welcome to Riverside County Assessor Online Services. County of Riverside - Prop 1A.

The Tax Collector is responsible for the billing and collection of secured unsecured supplemental transient occupancy tax as well as various other special assessments for the county school and. IRS Taxable Wage Limits. Redevelopment Assessed Valuation FY 14-15.

For in-person services please contact your local assessor office to schedule your appointment. Box 751 Riverside CA 92502-0751 951 486-7000 DOCUMENTARY TRANSFER TAX Sections 11901-11934 of the Revenue Taxation Code and Riverside County Board of Supervisors Ordinance. Request Form - Statement of Change Form - ACR205pdf.

The county most of the countys incorporated cities school districts and all other taxing agencies located in the county including special districts eg flood control districts sanitation districts. COUNTY OF RIVERSIDE ASSESSOR-COUNTY CLERK-RECORDER Assessor PO. Our forms are organized by department area and category below.

AR5 Cashbox Reconciliation Form. Personal Check Money order and cashiers check payments can be placed in an envelope and dropped into payment drop slot located at all public service locations. Welcome to the Riverside County Property Tax Portal.

Property Tax Payment Site. Change of Mailing Address. Riverside County Assessor-County Clerk-Recorder Office Hours Locations Phone.

The Assessor must complete an assessment roll showing the assessed values for all property and maintain records of the above. AR5 Cash Box Reconciliation. Riverside County Assessor-County Clerk-Recorder Office Hours Locations Phone.

It is our hope that this directory will assist in locating the site. Guide to Understanding Your W-2. Form DE 4 Employees Withholding Allowance Certificate CA only Request for Duplicate Wage.

Change of Property Address. The Assessor must complete an assessment roll showing the assessed values for all property and maintain records of the above. The Assessor does not set tax amounts or collect taxes.

Please note that changes to title may result in a reassessment of the property and a change in your property taxes. Property taxes are collected by the county although they are governed by California State LawThe Tax Collector of Riverside County collects taxes on behalf of the following entities. Assessor Department 714 834-3821.

Form W-4 Employees Withholding Allowance Certificate. 951 955-6200 Live Agents from 8 am - 5 pm M-F Click Here to Contact Us. These considerations should be made when recording an instrument.

The offices of the Assessor Treasurer-Tax Collector Auditor-Controller and Clerk of the Board have prepared this site to introduce taxpayers to the organizations that handle the property tax process in Riverside County. Gift tax or other legal consequences. Exemption Exclusion Forms.

If you want a copy of the tax book you actually need to pay 35 and send an official request to the following address. San Bernardino CA 92415-0311. Cash Tax Bond Inquiry.

Application for Installment Payment Plan. Assessor Department 714 834-2939. You can find the exact tax rate for your district online but the Riverside County Tax Assessor has not posted the information in one convenient downloadable pamphlet.

The Assessor must determine a value for all taxable property and apply all legal exemptions and exclusions. AR2 Revolving Fund Advance Request. AR4 Cash OverageShortage Monthly Report-Department Heads.

Riverside County Assessor-County Clerk-Recorder Office Hours Locations Phone. Assessor Department 714 834-5031. The Assessor does not set tax amounts or collect taxes.

Clerk of the Board 714 834-2206. Out of Bonding Request Form. These forms DO NOT allow for online submission and must be delivered by mail or in-person to your local Assessor-County Clerk-Recorder office.

Redevelopment State Reports FY 13-14. Riverside County Auditor-Controllers Office PO. Application for Property Tax Relief for Military Personnel.

Meet Your Treasurer Tax Collector

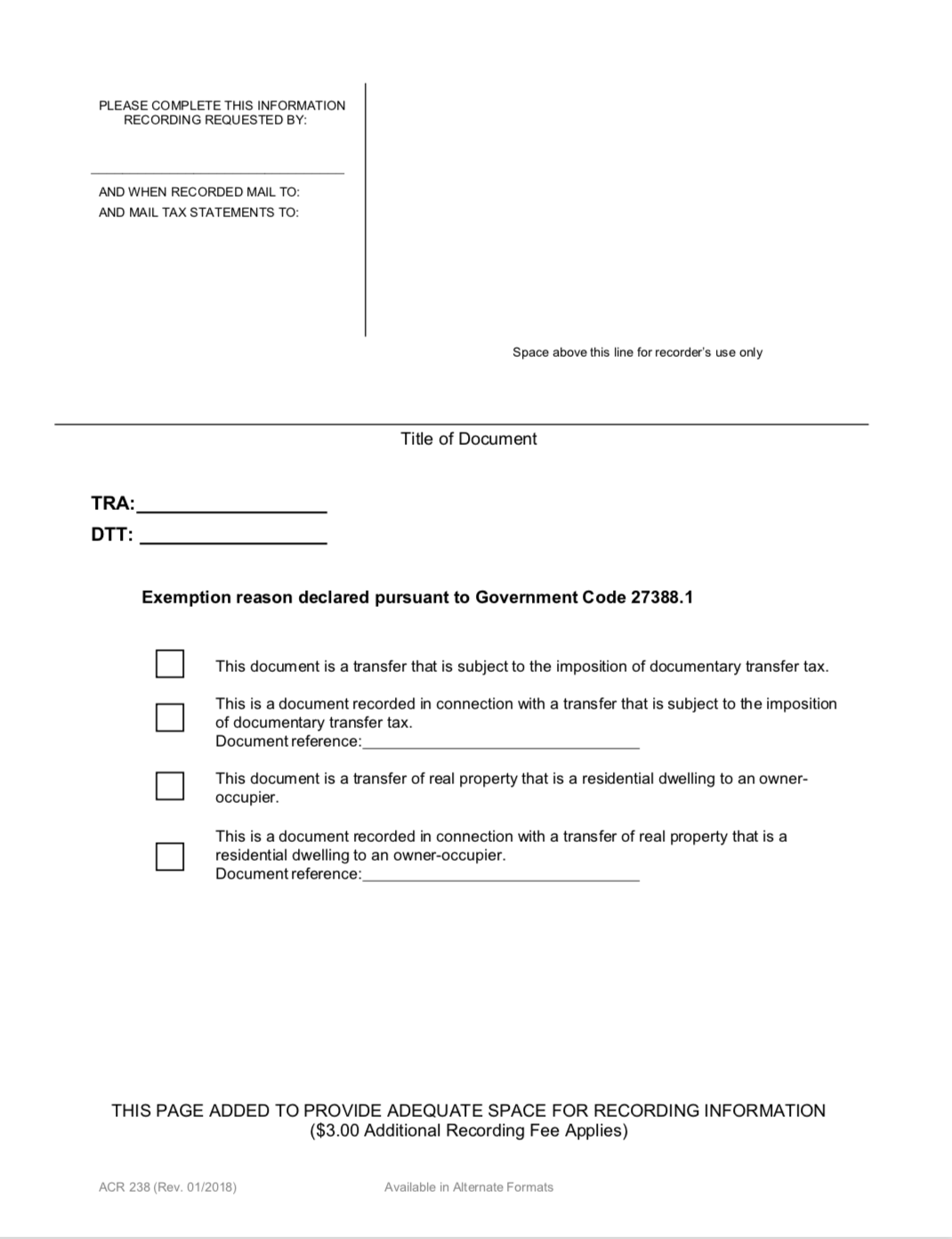

Riverside County Recorder S Cover Sheet For Recording Liens

Form Acr521 Download Fillable Pdf Or Fill Online Documentary Transfer Tax Affidavit County Of Riverside California Templateroller

Riverside County Assessor County Clerk Recorder Record A Document

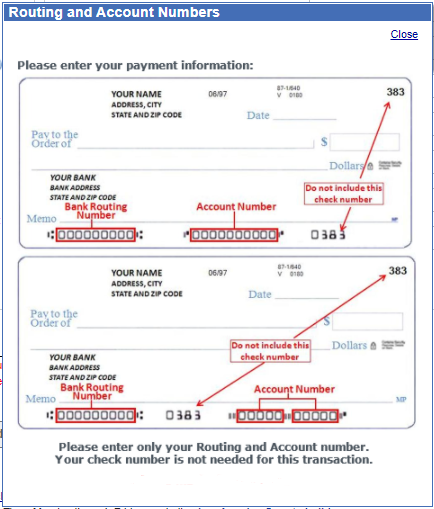

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

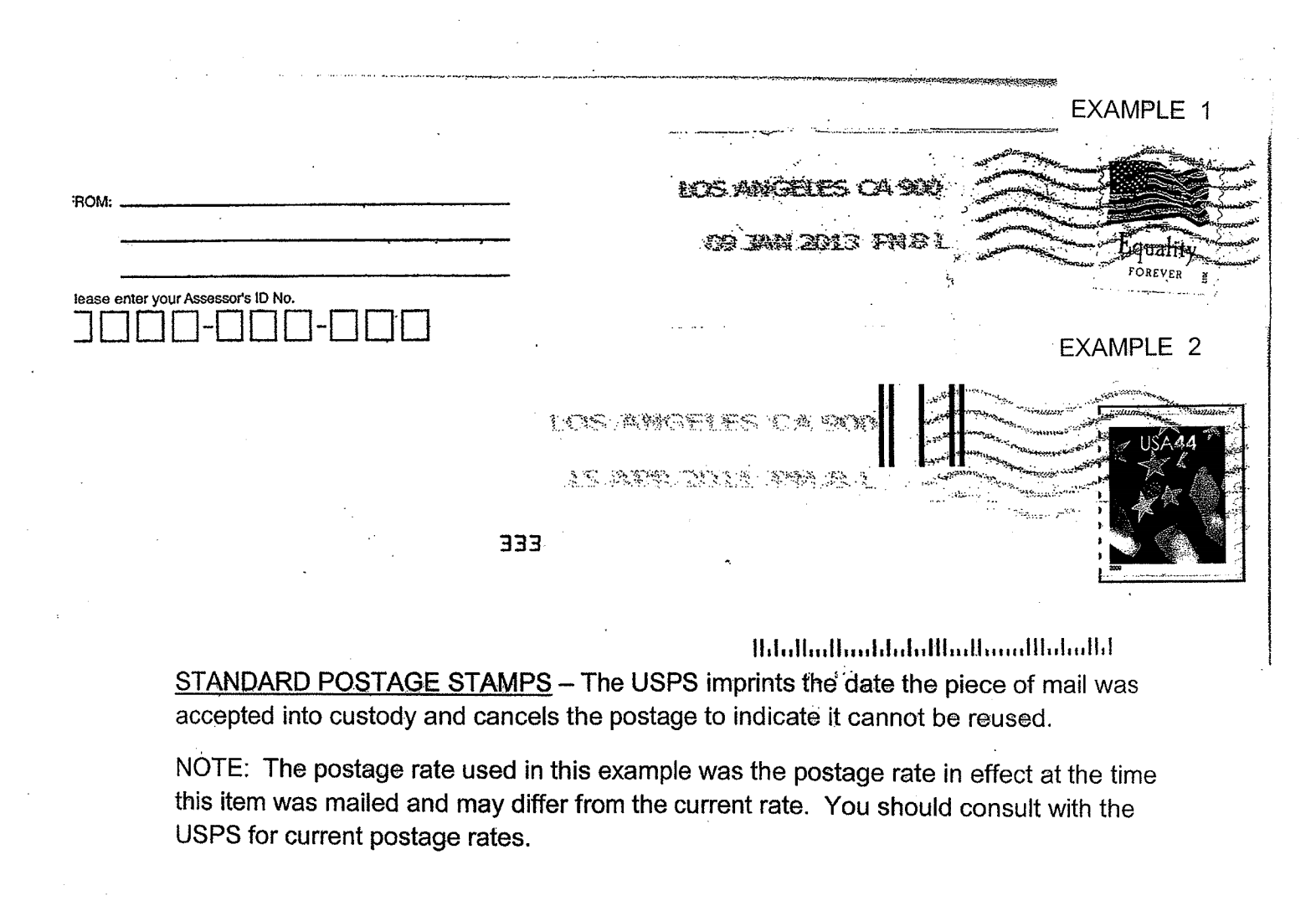

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

Form Acr521 Download Fillable Pdf Or Fill Online Documentary Transfer Tax Affidavit County Of Riverside California Templateroller

Understanding California S Property Taxes

Fill Free Fillable Forms For The State Of California